Ireland's Best Employee Rewards and Benefits Gift Card.

You choose the value - they choose the reward.

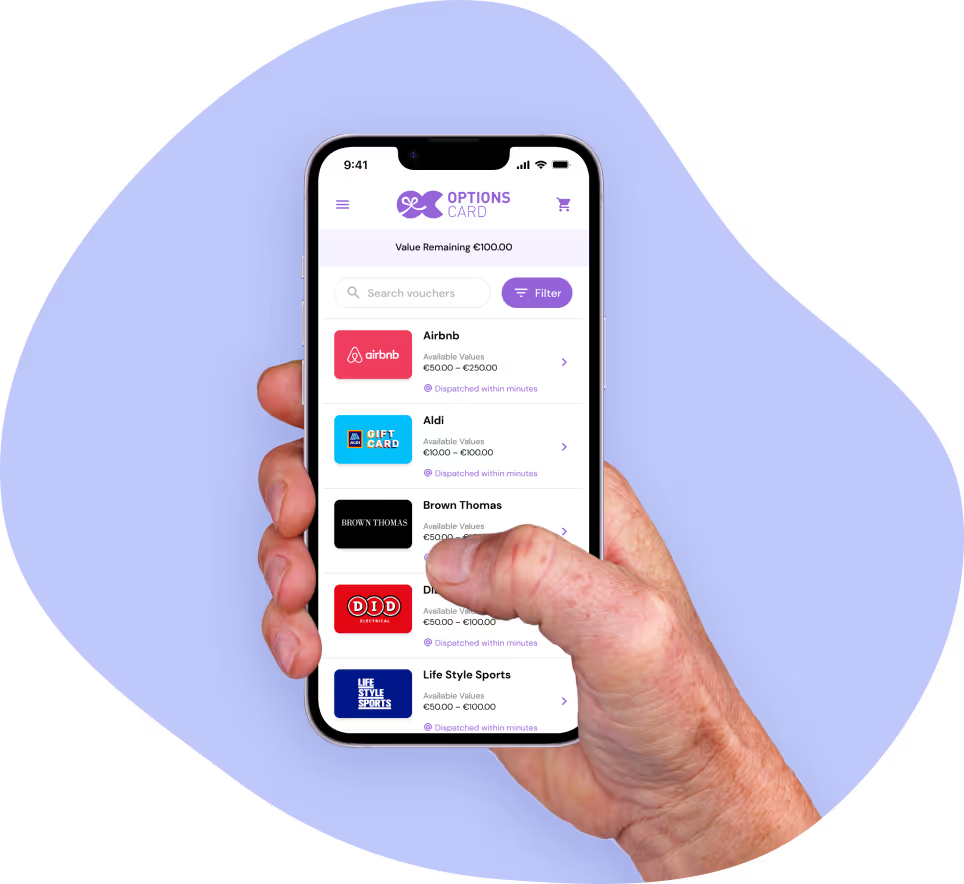

Let your employees choose from our prepaid MasterCard or a wide range or digital gift cards from Ireland's leading retail brands. Delivered Instantly.

Tax free up to €1,500 per employee.

What makes OptionsCard better for Employee Benefits

OptionsCard is all about …well options. The whole premise behind what we do is to enable your staff to use their tax-free value, that you have given them, in the way that suits them best.

If they want a spend anywhere MasterCard - they can have that. If they want, say, a gift voucher for Pennys, they can have that. If they want to send a gift card to a loved one for a present, they can do that too!

We allow the recipient to mix and match, choose something now and something else later.

Key Benefits for the recipients:

- 5 years validity

- No chipping of value

- Amazing support

- Re-gifting

- Unrivalled redemption choice

- Donate to good causes

- Add multiple OptionsCard's together

- No apps to download

- Live balance shown in your mobile wallet

Trusted by leading brands worldwide

Ways to use your OptionsCard Digital Gift Card

Swap for 60+ national retailer gift cards covering over 2800 retail and online stores in 26 counties

Donate to 5 global sustainability causes and 2 disaster and emergency relief agencies

Spend in 28,0000,000 acceptance partners of Mastercard worldwide

Corporate Account with OptionsCard

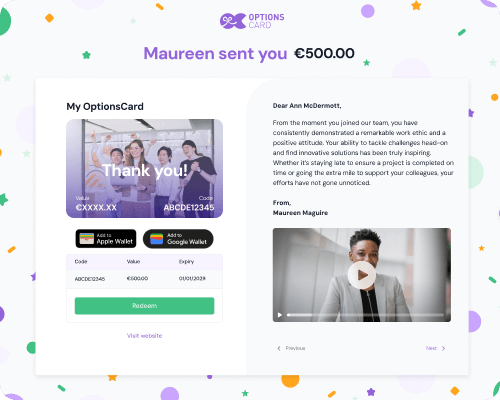

OptionsCard was created specifically to make the process of issuing rewards a great experience for our business customers. As a business customer of OptionsCard you'll have access to some to these great features and services:

Dedicated Account Management

- Agency approach to client accounts

- Named account handler

- Help with design and campaign management

Customisable Gifting

- Branding and messaging on all rewards issued

- Insert video messages

- Physical cards if required - load remotely as needed

World Class Support

- Ticketed and tracked email support

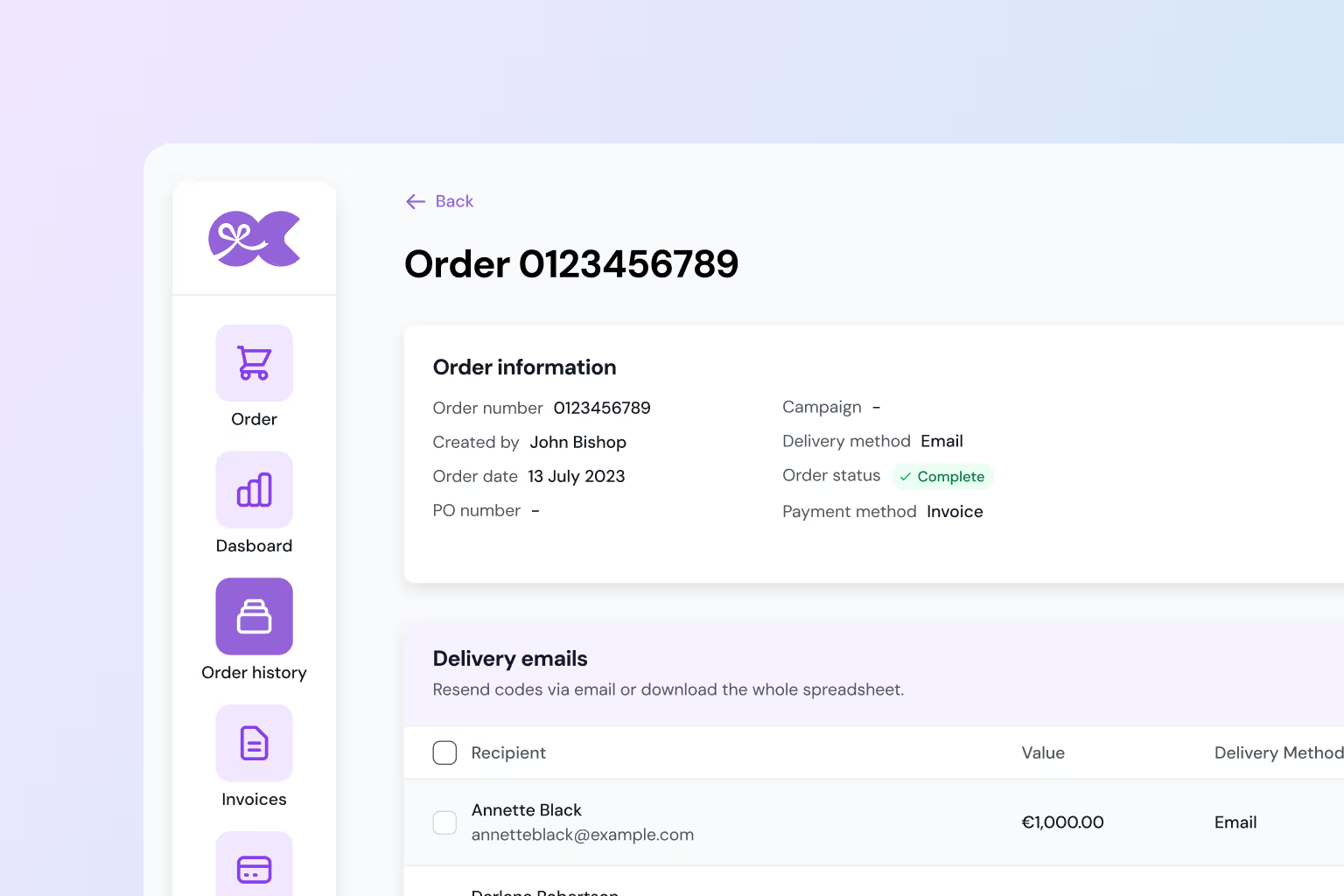

- Individual order history online

- Ability to resend gift cards if lost

- No fees for lost cards or reissuing

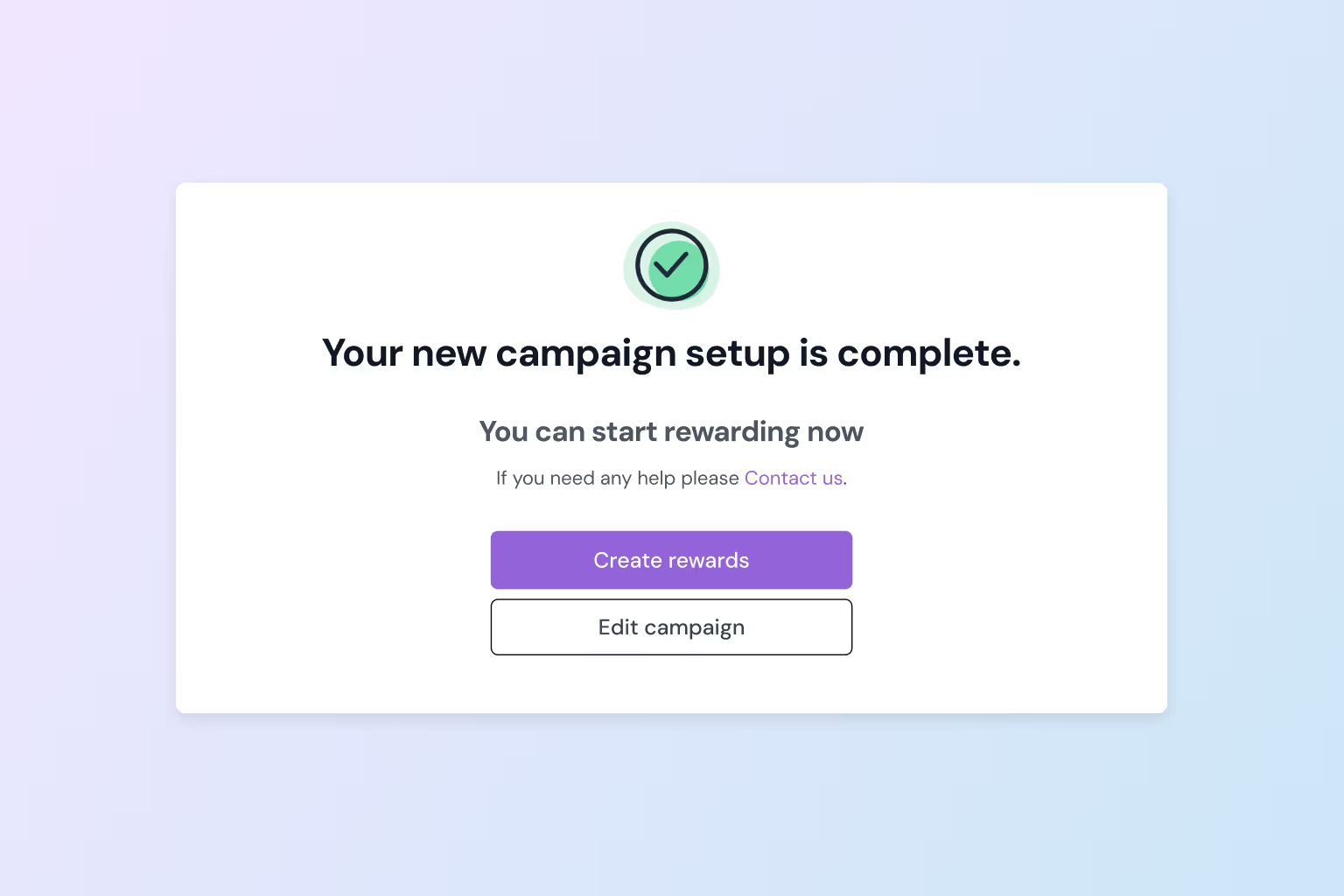

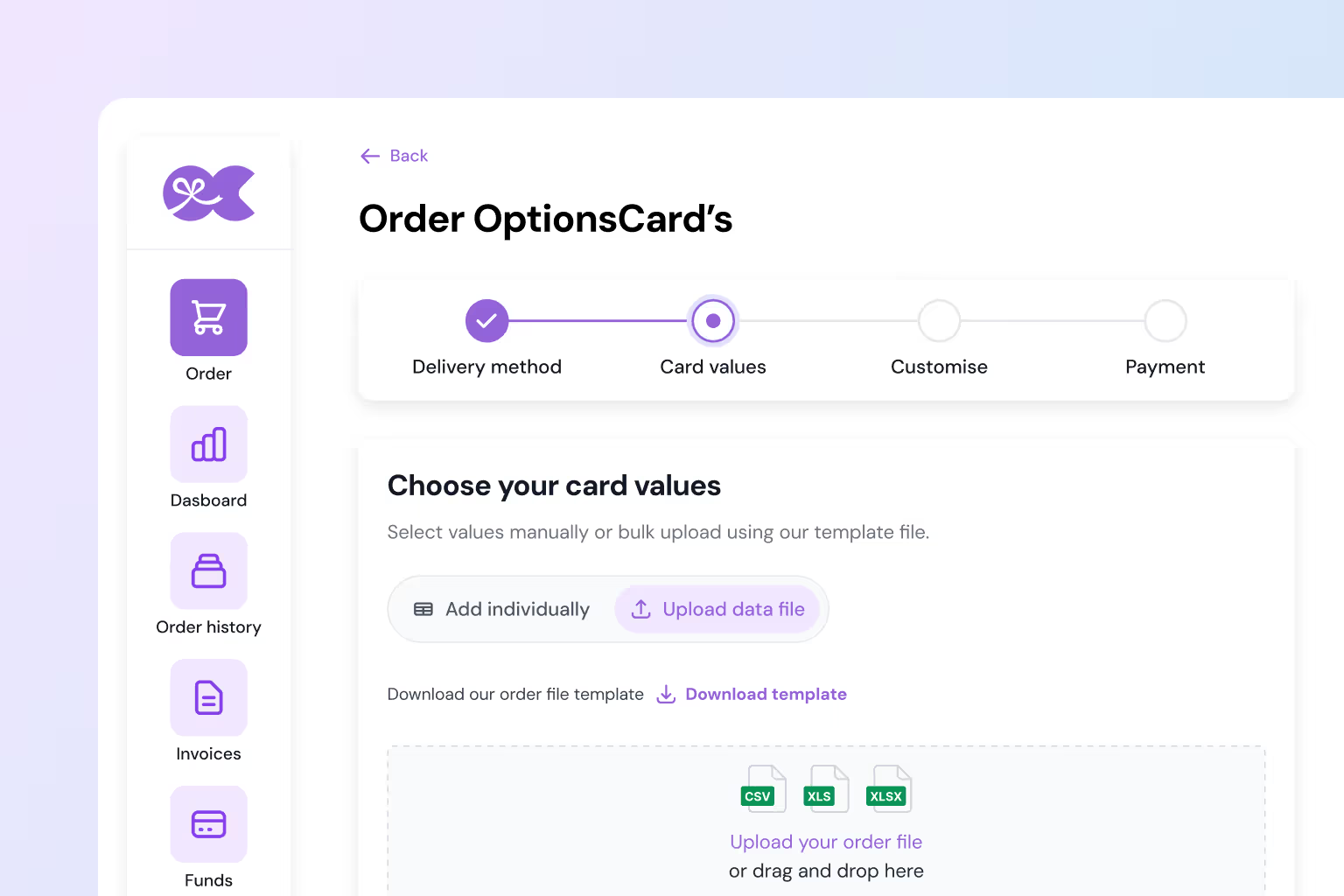

Online Account

- Send ad hoc individual or bulk rewards

- Manage resends

- Create reward campaigns

- Manage multiple POs and budgets

- User access control by department

- All order and invoice history

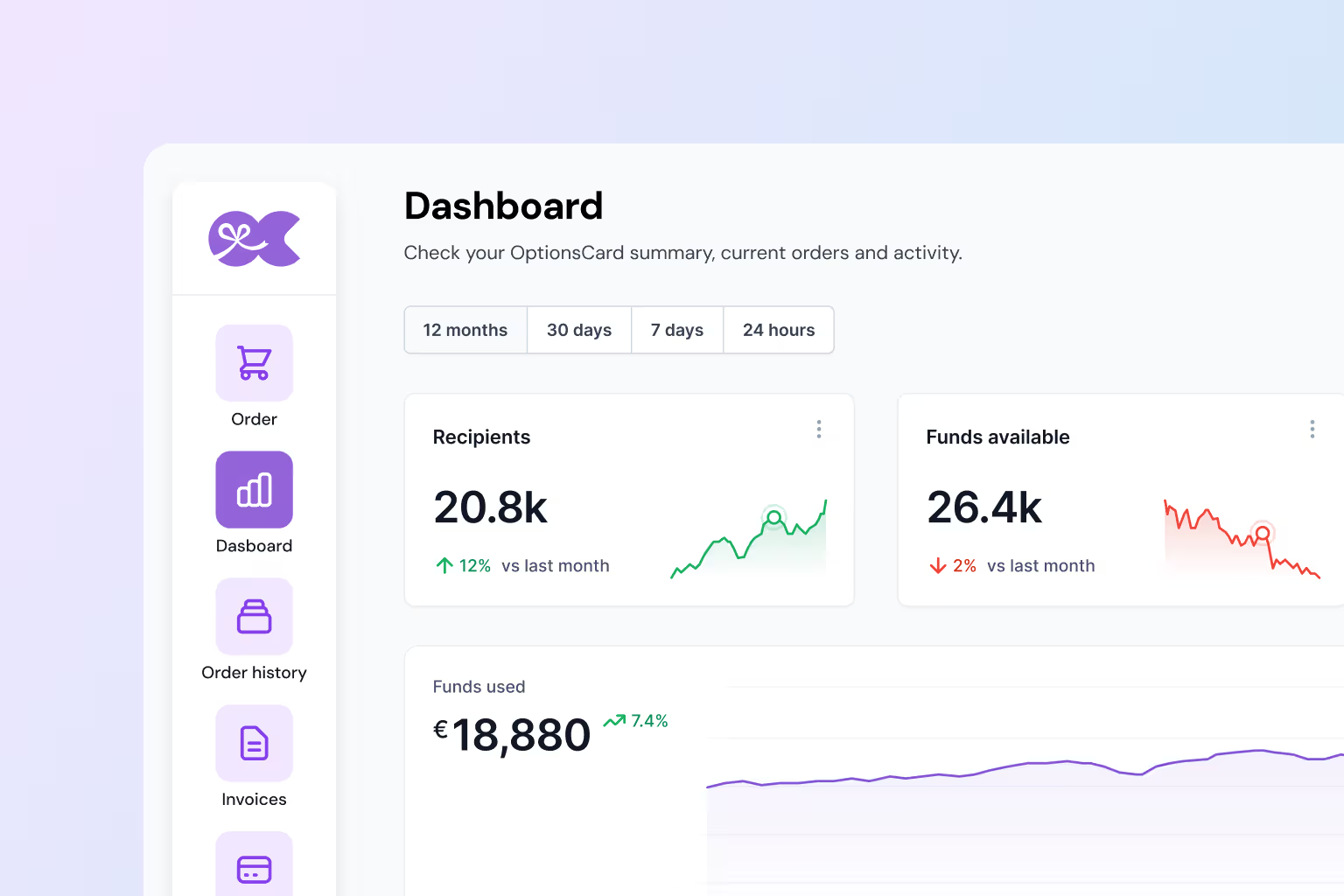

Reporting and Analytics

- See how your OptionsCard's are being used

- See delivery receipt confirmation

- Compare time periods

- Tax reporting files monthly / annually

Hollr Reward Card Mastercard Virtual Debit

Along with all the other gift card brand choices you can see on the website, the staff of our corporate customers also have the option of choosing a Hollr Reward Mastercard.

The Hollr Reward MasterCard is a virtual debit cards that sits in your mobile wallet, just like all our other debit and credit cards and that can be spent anywhere MasterCard is accepted. It is only available to employees of our corporate customers through an OptionsCard and is fully compliant with the Revenue rules for the Small Benefits Exemption scheme.

Key features include:

- ✅ No fee to activate

- ✅ No documents or ID needed for registration

- ✅ No apps to download

- ✅ Store easily in your Google Wallet or Apple Wallet

- ✅ Accepted by Mastercard anywhere worldwide — in-store & online

- ✅ Tap in-store or pay online with ease

- ✅ See your full balance live for 24 months

- ✅ Get an SMS balance update after each transaction

- ✅ Transaction history available online and in your phone wallet

Employers, give up to €1,500 tax free!

Irish Revenue's Small Benefit Exemption Scheme

Big Tax Savings

Under the Inland Revenue’s Small Benefits Exemption scheme an employer can give up to €1,500 in gift vouchers tax free to each employee or director each year. No PAYE, PRSI and USC is liable on the award by the employee or employer – enabling employees get a real cost of living bonus with great tax savings.

Up to €1,980 tax savings per person!

Clear rules to follow

- Tax-free vouchers or benefits can be used only to purchase goods or services. They cannot be redeemed for cash.

- This "cannot be redeemed for cash" bit is crucially as many 'spend anywhere' cards do not qualify and you could end up with a big tax bill. Always check the Ts&Cs – if you can redeem the gift card for cash, or use at an ATM, it will not be valid for the benefit.

- From 1 January 2025, you can give up to 5 small benefits, tax-free, each year, up to a total value of €1,500.

- If a single benefit exceeds €1,500 in value, the full value of that benefit is subject to tax. Where up to 5 benefits are provided, the combined value of those benefits cannot exceed €1,500.

- The scheme can be used for most types of employee rewards and bonuses and can be used by directors and officers too provided they are paid employees of the company. However, it cannot be used for salary sacrifice or in lieu of pay.

- The cut off date is Dec 31 each year

- From 1 January 2024 you must keep a record of the benefits given out to each employee and report this to Inland Revenue.

For the full details of the scheme see the Inland Revenue website here. And, of course, if it's not clear, ask your tax advisor first.

OptionsCard vs other cards

When considering OptionsCard gift cards as a gift or employee reward, there are some key attributes that you may want to consider. It's not definitive or exhaustive, but may help you understand your choices a little more clearly.

Compare multi store gift cards

“Limited Network” cards

Restricted to multiple named retail outlets only

“Spend Anywhere” cards

Prepaid debit Mastercard or Visa cards

Want to gift your employees?

Buy up to €25,000 of OptionsCards online now when paying by invoice.

For larger or corporate gift card customers give us a call on 01 575 9732 or contact sales.